After a moody 2017 and bearish 2018, the blockchain space seems to be somewhat stable in the first half of 2019 according to several blockchain report releases and has an upward trajectory with new developments. Although the number of ICOs has significantly reduced – there is a silver lining: there are fewer bad apples to distract the crypto ecosystem. This post-ICO, post-futile-PR-partnerships age urges the blockchain community to be less focused on the current price of bitcoin and more focused on producing meaningful services and advancements.

The first half of this year was full of blockchain POCs led by enterprises in almost all crucial sectors, including financial services, supply chain, and healthcare. Big projects from established enterprises like Libra are taking all the media space now, and it seems like the enterprise blockchain space might be back in form soon. A lot of key consultancies have started speaking on blockchain again. However, there hasn’t been a centralized source for information about this decentralized technology that clearly states the condition of the market and explains the sentiments in the first half of 2019.

Hence, the analysts at Deqode went through several latest blockchain-related reports, articles, and surveys from a long list of organizations. They chose six latest observations from six publications on multiple factors (organization credibility, vision, etc.) which are indicative of the industry’s mood, and compiled their key findings in a single document. This report contains concise, abridged information and observations taken from six major sources: McKinsey, BCG, PwC, Deloitte, KPMG, and Qetlas.

McKinsey and Company

After drafting the infamous Blockchain’s Occam Problem article which received much flak from the blockchain community for calling the technology relatively complex, expensive, unstable, and unregulated, ‘the Firm,’ seems to have changed its tone. While it is alarming that a company so revered and pro-blockchain hasn’t talked about the tech a lot post-Occam Problem in January, their latest piece on the technology, Blockchain and retail banking: Making the connection highlights ‘several areas where the technology could create value for retail banks.’

In particular, McKinsey is keen on three use-cases:

- Remittance

- KYC and Fraud Detection

- Risk Scoring

However, McKinsey lists four significant issues that need to be solved before Blockchain’s application into retail banking. These issues seem to be generic ones that could be applied to several sectors. The firm also lists solutions for the same:

- Challenge: Blockchain networks are transparent to their members, meaning that there are limitations to anonymity in some scenarios.

- Solution: Several companies are experimenting with “tokenization,” which disguises sensitive data by substituting it with a token that serves as a reference.

- Challenge: Real-time settlement is currently impossible due to the lack of fungibility between crypto-assets and fiat currencies.

- Solution: Stablecoins are one solution, but they will require correspondent banks to make the eventual conversion.

- Challenge: Costs associated with switching from individual to shared systems, questions about accountability, cultural and practical challenges Solution: Banks must create large networks to achieve benefits at scale, requiring data standardization and collaboration, and solve the so-called coopetition paradox.

- Challenge: Customers may choose to restrict access to protect their privacy and security.

- Solution: Financial institutions are likely to need to work hard to bring them on board.

This blockchain report, in conclusion, suggests four points that could help increase adoption:

- More seamless transition between fiat and digital assets, so that customers do not risk losses as they switch back and forth.

- Regulation, so that participants have certainty around the status of crypto assets, rules of engagement, and investor protection.

- Consumer identities should be created on the Blockchain, enabling banks to offer real-time loan decisions based on authenticated ID.

- There needs to be a strategic watershed. Executives need to believe that the long-term benefits of Blockchain are worth the cost.

Boston Consulting Group

When the most innovative consultancy of the big 3, BCG, published Capturing the Value of Blockchain in April of 2019 – it brought many enterprisey-eyes on the technology. BCG sets the record straight by starting the article off by claiming that investors are continuing to pour record-breaking sums into space. It then goes on to list four primary sources of value that blockchain use cases can deliver:

- New Business Models

- Operational Efficiency

- Risk Mitigation

- Social Impact

BCG then talks about the determination of models, where it lists ‘Linear’ and ‘Network Effects’ for the same. They explicitly state that while blockchain use cases that deliver network effects have the potential to be true disruptors, it requires the following:

- Significant financial and technical resources

- High tolerance for risk

- The ability to convince a critical mass to join a nascent platform

- An established POC

BCG lists three most promising use cases for eight specific industries according to the linear, network effects, and their hybrid models – and mentions how the technology is still new, the list of possible avenues to take are wide and the operational and partnership requirements to deliver on any of them are often extensive.

PwC

PwC survey of 600 executives starts with six critical figures:

- 84% of respondents are actively involved with blockchain

- 45% believe trust could delay adoption

- 30% see China as a rising blockchain leader

- 28% say interoperability of systems is a key for success

- 52% of companies are in the R&D phase

- 15% have their projects live

Three critical observations from their blockchain report include:

- Financial services will be the current and near-term leader of blockchain.

- Potential in industrial products, energy and utilities, and healthcare.

- The US is the most advanced territory in developing blockchain today. In three to five years, China will take over.

A majority of their survey then focuses on blockchain’s barrier to adoption:

The beautifully phrased final section, titled ‘Why it’s hard to trust a blockchain’ should be read in its entirety:

Blockchain, by its very definition, should engender trust. However, in reality, companies confront trust issues at nearly every turn. For one, users must build confidence in the technology itself. As with any emerging technology, challenges and doubts exist around blockchain’s reliability, speed, security, and scalability. Also, there are concerns regarding a lack of standardization and the potential lack of interoperability with other blockchains.

Also contributing to the blockchain trust gap is a lack of understanding. Even now, many executives are unclear on what blockchain is and how it is changing all facets of the business. Although the public narrative has moved beyond bitcoin, even the more recent focus and hype around ICOs only hint at the potential impact. Blockchain’s role as a dual-pronged change agent — as a new form of infrastructure and as a new way to digitize assets through tokens, including cryptocurrency — is not easy to explain. Think about other new technologies: users can try on virtual reality goggles or watch a drone take flight. However, blockchain is abstract, technical, and happening behind the scenes.

Another challenge for blockchain is building trust in the network. It is perhaps ironic that a technology meant to bring consensus hits a stumbling block on the early need to design rules and standards. Take payment systems and mechanisms in banking. Though everyone plays by the rules of existing systems today, they don’t necessarily agree on how an alternative blockchain-based model should be designed and operated.

Likewise, there’s a lack of comfort regarding regulation. The majority of regulators are still coming to terms with blockchain and cryptocurrency. Many territories have begun studying and discussing the issues, particularly as they relate to financial services, but the overall regulatory environment remains unsettled.

Deloitte

Compared to other studies, Deloitte’s survey (n=1386) is one of the most optimistic blockchain surveys in 2019. Key findings include:

- 53% (2018: 43%) of enterprise respondents cite blockchain as a top-five strategic priority

- 56% (2018: 59%) believe blockchain will disrupt their industry.

- 6% are unsure or don’t see the need to use blockchain.

- The top five blockchain advantages:

- New business models and value chains (23%)

- Greater security or lower risk (23%)

- Higher speed compared to existing systems (17%)

- Greater transparency (11%)

- Lower costs (9%)

- The survey respondents were biased towards IT executives (56%)

- 42% of startups cited the main blockchain benefit as new business models and value chains compared to 23% for enterprises

- Additionally, enterprises have a greater belief that blockchain provides greater security (71%) as opposed to 48% of startups

- 86% believe that blockchain technology is broadly scalable and will eventually achieve mainstream adoption

- 43% view the technology as overhyped

- The top five barriers to greater blockchain investment are:

- Implementation

- Regulatory issues

- Potential security threats

- Lack of in-house capabilities

- Uncertain ROI

- The top five use-cases are:

- Technology, media, and communication (26%)

- Financial Services (15%)

- Manufacturing (12%)

- Retail, wholesale and distribution (7%)

- Professional services (6%)

KPMG

KPMG surveyed 740 global technology leaders for its 2019 Technology Industry Innovation Survey. Following are their findings in the context of blockchain technology:

- 48% percent of respondents said blockchain would likely or very likely change the way their companies do business within three years

- The rest of the respondents were neutral (24%) or didn’t believe (27%) blockchain will change their company’s business processes within three years

- 41% said it was likely or very likely for technology companies to implement blockchain within the next three years, 31% were neutral and 28% said they wouldn’t, or it’s unlikely

- IoT was the most promising area (27%) for blockchain disruption in the next three years. Trading such as platforms for small businesses came second with 22%. Reducing cyber risk (for instance, using ledger identity authentication), was ranked third with 20%. In fourth place was contracts (18%) including payments, insurance, and blockchain identity

- The top three blockchain adoption challenges:

- Unproven business cases (24%)

- Technology complexity (14%)

- Lack of capital or funding (12%)

teQatlas

TeqAtlas is a blockchain, IoT and AI analysis and research company. We couldn’t establish the proof of credibility of their reports so their findings must be taken with a grain of salt. Four key observations from them include:

- Digital Currency Group dominates in the number of deals, 32 deals ahead of the next two investors combined (Pantera Capital and Blockchain Capital)

- A majority (8 out of the top 10) of the most active blockchain investors are located in the US. More than half of all investors are Venture Capital firms.

- Majority of investors are focused on FinTech blockchain startups

- Financial sector seems to be the fastest way to get investments – it has over 150 deals

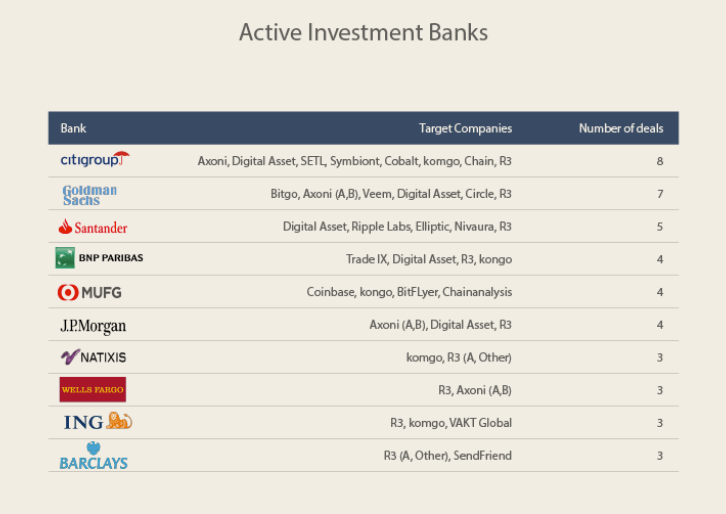

The following are the most important charts:

Six Important Takeaways

- Financial Services emerges as the most promising use-case of them all

- Blockchain technology is still in the nascent stage

- Cognitive bias against blockchain technology still exists

- The three biggest hindrances in front of mass adoption seem to be:

- Co-opetition paradox

- Regulatory Issues

- ‘Unproven’ business cases

- New business models (for instance, p2p energy trading) – is something organizations can bet on

- Sentiments seem to be better in the first half of 2019 than its 2018 counterpart

Disclaimer and Fair Use Statement for Blockchain Report 2019

This document contains quotes and statements from different organizations – the use of which may not have been specifically authorized by the copyright owners. This blockchain report is available to explain issues relevant to blockchain or to illustrate the current condition of the blockchain industry. Any bit of information in the blockchain report from McKinsey, BCG, PwC, Deloitte, KPMG, and Teqatlas – and other organizations named in this document are the properties of the respective companies. This document has no commercial value. The document constitutes a ‘fair use’ of any such copyrighted material (referenced and provided for in section 107 of the US Copyright Law).

The opinions and interpretations contained in this blockchain report are based on different organizations’ publically available blockchain reports and surveys – hence, Deqode does not take responsibility for the verifiability of the statistics present in them. If you wish to use any copyrighted material from this site for purposes of your own that go beyond ‘fair use,’ you must obtain permission from the copyright owner.

Suggested Reading: https://deqode.com/blog/investing-in-cryptocurrency/

1 Comment

Pingback: Deqode's CEO in an interview with GoodFirms | Deqode Blog