The 2008 financial crisis impacted banks in ways they couldn’t imagine. As a result of the crisis, a number of new regulations such as Basel III and Dodd-Frank were introduced that placed more stringent requirements on banks. Subsequently, banks have been forced to de-risk their balance sheets and are now much more cautious about whom they do business with. Because of this, smaller companies that are deemed less creditworthy and subsequently more risky by banks are finding it more difficult to obtain loans and face high-interest rates when borrowing money. This has made it more difficult for small companies to acquire capital, and as a result, many small firms struggle to gain the cash they need to grow. This is where blockchain technology could step in and disrupt supply chain finance.

Establishing a general definition of supply chain finance

(Supply chain finance is) The use of financial instruments, practices, and technologies to optimize the management of the working capital and liquidity tied up in supply chain processes for collaborating business partners.

Euro Banking Association

Supply chain finance refers to the use of short-term credit to balance working capital between a buyer and a seller, thus minimizing aggregate supply chain cost. This decreases currency risk and ultimately improve liquidity. To understand how blockchain could fit in and improve supply chain finance, we need to establish a standardized definition, for the sake of this article.

A traditional supply chain finance model typically involves 3-4 parties:

- Buyer

- Supplier

- Financiers

- Third-party technology firm that provides and manages SCF solution

Further, supply chain finance could be broadly classified into two categories

1. Buyer led SCF: The buyer’s payables are used as collateral in a financing agreement

The buyer (usually a large company) starts the process of choosing invoices – this means that he will pick the ones he will ask the financier to pay early. Post this, the supplier looks at all his invoices, and decides which invoice financier should pay early. It is a collaborative project between the ordering party, the supplier and the financier.

a. Reverse Factoring

- The buyer purchases supplies and the invoice is processed

- The buyer’s financing institution or third-party funder is notified and then provides early payment to suppliers on behalf of the buyer

- In exchange for receiving early payment, suppliers will provide a discount to the financing institution. Suppliers are generally willing to accept this trade-off because the rate of financing offered to them is based on the credit of the buyer. It tends to work most effectively when the buyer has a higher credit rating than the supplier

- After the financial institution pays the supplier, the buyer is free to negotiate new payment terms with them and extend their DPO. This allows the buyer to hold onto their cash for longer and use it for other business purposes

- Buyer pays the financing institution, and they pay the full cost of invoices instead of the discounted rate provided by the supplier to the financing institution

This leads to the following for each entity:

Supplier:

Suppliers can gain access to capital much earlier than normally would be the case and can subsequently lower their Days Sales Outstanding (DSO), which ultimately means they get paid sooner. While the receipt of early payment comes at the cost of a discount, the cost of financing they receive through the SCF program is more affordable than they would be able to receive on their own. Thus, they come away with comparative gains.

Buyer:

On the buyer side, companies are able to forego payment for much longer than would normally be the case, which subsequently increases their Days Payable Outstanding (DPO) and allows them to manage working capital levels by holding onto their cash for longer periods of time. This allows them to either extend the length of investments and generate larger returns or pay off other cash outflows. (Traditional SCF programs tend to be most successful for large corporate buyers who would prefer to hold onto their cash for longer in order to meet short-term liabilities and cash outflows or to generate greater returns on cash through investments in the market.)

Financier:

The participating financial institution in a traditional SCF transaction also benefits, as they provide payment to the supplier on behalf of the buyer at a discounted rate, but end up receiving payment in full from the buyer at a later date, thus walking away with a net profit.

b. Dynamic Discounting

Using dynamic discounting, buyers accept the drop in their DPO in exchange for early-pay discounts from their suppliers. Dynamic discounting programs are often self-funded, meaning the buyer uses their own available cash to pay suppliers directly and does not involve financiers. This approach is valuable for firms in cases when the returns available through discounted invoices are just as high if not higher than what they could generate through alternative investment opportunities in the market.

2. Supplier led SCF: The supplier’s receivables are used as collateral in a financing agreement

Invoice Factoring

A supplier sells its accounts receivable (invoices) to a financier at a discount and sometimes factors its receivable assets to meet its present and immediate cash needs. It might also factor its invoices to mitigate credit risk. Invoice factoring is supplier-initiated, unlike reverse factoring. The interest rate offered by the financier for reverse factoring is lower as compared to invoice factoring.

Many SMEs are too small for any bank to consider. They won’t put a lot of time into factoring small invoices when they could earn more processing invoices from a larger enterprise. For example, factoring in India delivers a reported $219 Billion USD to the country’s micro, small, and medium enterprises (MSMEs). But that leaves another $188 Billion USD on the table as “unmet demand”—invoices no one else wants. On our platform, it will be possible for financiers to bid on sets of invoices with lower risk.

Current SCF (Reverse Factoring) Solutions

Current SCF solutions are basically a buyer-side implementation of a supply chain program, built upon platform provided by a third-party technology solution provider.

Buyers invite target suppliers to participate in the program. Once a supplier accepts the invitation, they are onboard into the platform and their finance team is trained on how to use the processes and tools that will facilitate invoice trading.

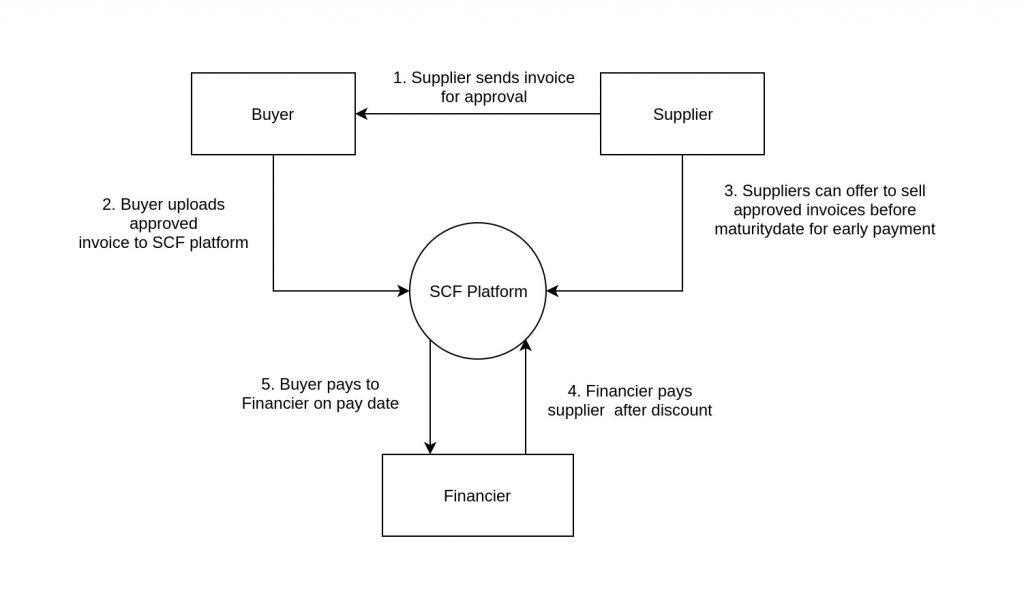

After onboarding the following steps take place

- Supplier submits an invoice to the buyer following normal protocol.

- Buyer approves the invoice and uploads it on the platform.

- Supplier selects the invoice for early payment and requests the financier on the platform.

- Financier receives and processes the request and provides early payment to the supplier. Total amount minus financing fees or discount.

- On the invoice’s due date buyer is notified to pay the financier.

Issues with the existing system

Evidently, the current system faces several huge problems, described as follows:

1. Centralization, as SaaS provider controls the database

2. Additional risk, as suppliers can double spend the same invoice to multiple financiers

3. Delayed timeline, as more steps are involved before the supplier’s invoice is approved by the buyer. These steps are slow due to multiple intermediaries and manual contract execution. Here’s a brief overview of them:

- Buyer

send the purchase order to the supplier and supplier responds with the invoice. - Payment terms between the buyer and the supplier are established via a financial agreement. Financial agreement stores details such as quantity of goods sold, price and delivery time.

- Buyer’s bank receives the agreement for review. The bank reviews it and provides the Letter of Credit (LoC) to a correspondent bank and that bank shares the LoC with the supplier’s bank.

- Supplier’s bank notifies the supplier. Supplier initiates the shipment. Several manual inspections take place while the goods pass from the customs of both importing and exporting countries.

- Finally, the buyer receives the shipment and now he can approve the invoice.

4. Pre-shipment and at-shipment financing are risky due to the limited quality of available data.

5. Lack of visibility as different entities want to keep their data private.

Suggested Reading: Banking on blockchain – how blockchain is reshaping the banking industry

How a blockchain based system would revolutionize supply chain finance

Blockchain technology clearly has the potential to be a game-changer for supply-chain finance. A blockchain-based supply chain finance solution will essentially enable all parties in a supply chain finance solution to act on a single shared ledger more specific via smart contracts.

We need to keep in mind that a public blockchain or a cryptocurrency is not suitable for a supply chain finance solution as businesses do not want all of their data in public. The best solution here is

Permissioned Blockchain Promises

- Decentralization: Every participant runs their own node and hence everyone stores the share data.

- Immutability: Transaction history is maintained. All digitally signed transactions are recorded by all the participants hence it is not possible for a participant to deny their actions.

- Selective transparency: Data that is mutually important can be updated in real-time giving transparency. In a blockchain based system, it is possible to create channels between parties. Information shared via channels will only be visible to parties involved in creating that channel. For example, a financier might promise different reverse factoring discounts to different buyers. This information will not be public and one buyer will not know the discount that was promised to the other party.

- Trust: The system can eliminate problems with disclosure and accountability between companies whose interests are not necessarily aligned, thereby providing a solution for limited information sharing in the supply chain because of low trust

- Safety: Blockchain is based on cryptographic functions and digital signatures. it also brings in transparency along with it.

- Efficiency: Cost reduction, by removing paperwork for orders and invoices – and increased speed, by automation and shared flow of information. The system leads to a faster and more efficient sending, approval and payment of orders and invoices, and quick tracing of errors.

Must Read: Key concepts of blockchain – the very basics of blockchain technology

General blockchain use-cases examples

1. Blockchain can cut onboarding cost by reducing the need for extra KYC checks. By sharing checks and registering them on a blockchain, banks will no longer have to do a second check. This allows for a reduction in onboarding costs and the inclusion of more SMEs in RF.

2. A 2016 study found that invoice fraud costs UK companies 9+ Billion pounds ($13.2 Billion USD)1 every year. All in all, experts say about 1 in 100 invoices is fraudulent. A supplier using invoice factoring service could approach more than one financiers with the same receivable at the same time to get duplicate financing, a classic double-spend problem. Blockchain has the perfect use case for this scenario, banks can share the invoice data ( to ensure privacy they can share only the hash of the invoice data) with one another and prevent this kind of fraud.

Suggested Reading: The 101 of blockchain in fintech industry

Overview of the Solution

The solution takes into account a single consortium of buyers, financiers, suppliers, and shippers. It will have a single common platform for every party -and every entity will benefit from it. The platform will be a hybrid of both buyer and supplier-led supply chain finance solutions and will provide different options. As more and more buyers join the consortium this platform will become one shop stop for the financiers and suppliers. Selective transparency provided by

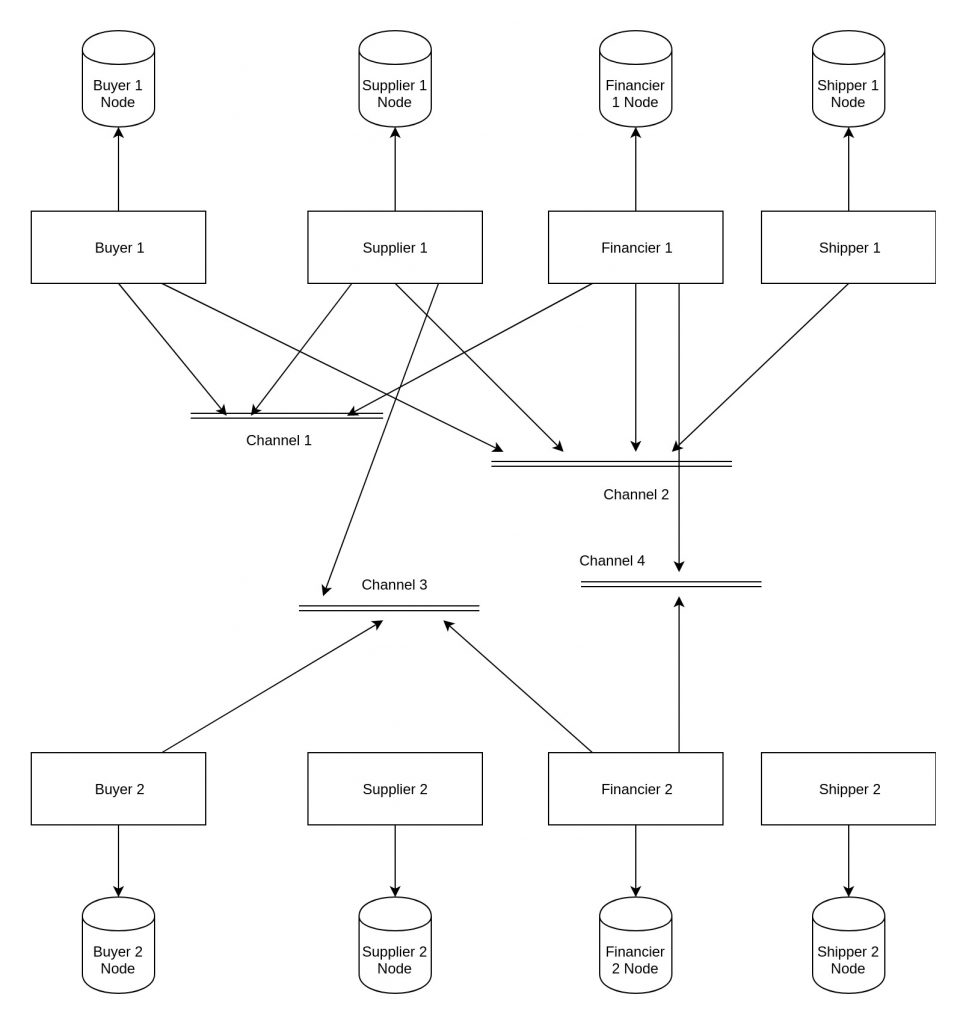

In the proposed solution, all members of the consortium will run their own node. Different participants will be able to create channels among themselves where they can share the data that they want to keep private from other members of the consortium.

As explained in the figure above

Channel 1: Buyer1, Supplier1, Financier1 create a channel where they can set goods amount, price, financing fees for a reverse factoring solution. This data will be immutable and selectively transparent.

Channel 2: Shipper1 creates a channel with Buyer1, Supplier1, Financier1. Each participant on the channel will be aware of the status of the shipment. Quality of data available is high and that will be helpful for pre and at shipment financing.

Channel 3: Supplier1 creates a channel with Buyer2 and Financier2. This channel is different from channel1. This way Supplier1 can offer different rates to different buyers for the same product and they will not know.

Channel 4: Financier1 and Financier2 share a channel where they share the KYC details. This cuts onboarding cost by reducing the need for extra KYC checks. Our platform also supports invoice factoring. In this case, supplier can submit the same invoice at the same time to both of the financiers. This channel will help to prevent such invoice fraud. On this

Conclusion

As the solution shows, blockchain is a game changer for supply chain finance. Financial services companies should start shaping their technology strategies around blockchain because it will clearly propel them to become an industry leader. For more details regarding the solution, please drop your email here.